Disclaimer: This week’s TMA is focusing on the increase of the Value Added Tax (VAT) to 18 percent.

01. Reducing legitimacy for increasing taxes

Issue:

Implementation of the VAT revision

During the Budget Speech for 2024, President Ranil Wickremesinghe–in his capacity as the minister of finance–announced that the Value Added Tax (VAT) will be increased from 15 percent to 18 percent.[1][2] Accordingly, the revised VAT was implemented from January 1, 2024.[3][4] Subsequently, the prices of several goods including fuel were increased.[5][6]

Introduction of the TIN

During the budget debate, Wickremesinghe also announced that the government will take measures to assign a Taxpayer Identification Number (TIN) to citizens over the age of 18 years.[7][8] At the time of writing this TMA, the Inland Revenue Department (IRD) noted that nearly one million Sri Lankans have registered to obtain a TIN.[

9][10]

Analysis

Criticisms of the revised VAT dominated last week’s media coverage. The print media including its editorials and political columns were strongly critical of the revision. Social media posts were stronger in their criticism and ridiculed the revision through the use of humour (refer to this week’s memes).[1] Meanwhile, TV reportage featured both critical and supportive voices of the VAT revision (please refer to TV findings featured in this issue of TMA). The state-owned Sinhala newspapers, Dinamina and Silumina, and TV channels, Rupavahini and ITN, allotted space for contesting views. The political voices in support of the revised VAT were marginal and limited to a few UNP members.

This week’s TMA will unpack the media reception of the revised VAT in two parts. First, it will assess the perception and sentiment of the tax increase. Second, it will map the positions of political parties on the increase of the VAT.

I. Assessing the perception of the tax increase

In the year following the worst-ever economic crisis suffered in Sri Lanka, with shortages of essentials, long power-cuts and interminable queues for fuel in 2022, the dominant Sinhala media framing on increasing taxes was that it was necessary for economic recovery.[2] From the rate of eight percent, the VAT was increased first to 12 percent in May 2022 and then to 15 percent in September 2022.[3] The Sinhala media voices were broadly sympathetic of this large increase of seven percentage points, seeing it as supporting measures to raise much needed government revenue.

By contrast, at present, the implementation of the revised VAT has been met with a high degree of criticism even though the increase of the VAT is smaller, a three-percentage point increase from 15 percent to 18 percent.[4] The negative reception appears to be underpinned by the perception that the government lacks sound policies for economic growth and productivity. In this context, the Sinhala media appeared to position the increase of the VAT as a measure taken by the government to compensate for its incompetence and corruption. Thus, a closer reading of the Sinhala media coverage reveals a sense of anger and injustice directed towards the government, bureaucrats

and mudalalis (shop keepers) associated with implementing the revised VAT. The following section briefly unpacks the grounds for the criticisms directed towards these three actors.

i. Incompetence and insensitivity of the government

The brunt of the criticism was directed towards the government. The Sinhala media perceived the government as incompetent in managing the economy and insensitive to the plight of the public. The following section unpacks three grounds for this criticism towards the government distilled from the media coverage.

a. Lack of tax collection from influential organisations

First, the government came under criticism for failing to collect taxes from influential organisations. In particular, the government was criticised for large scale failure to collect taxes from industries generating high revenue. For example, the Sinhala media highlighted the failure of the government (and the excise department in particular) to collect taxes from several distilleries, including the Mendis Distillery.[5] In the past, similar criticisms were levelled against the government for its failure to collect taxes from casinos.[6]

b. Lack of equity in the way the tax burden is distributed

Second, the government came under criticism for failing to distribute the tax burden equitably. Two such criticisms can be unpacked.

First, the government was criticised for levying taxes on consumer goods essential for people’s livelihoods instead of generating revenue through other forms of taxes. Some Sinhala press voices highlighted that generating revenue through the imposition of the Wealth Tax (targeting higher income earners) instead of increasing the VAT would be more equitable.

Second, the government was criticised for failing to hold some wealthy businesspersons and MPs accountable for evading taxes. For example, SJB MP Sajith Premadasa called on the government to recover the stolen money from the ‘thieves’ instead of taxing the people.

c. Lack of consistent trade taxes due to corruption

Third, the government came under criticism for failing to maintain consistent trade taxes due to corruption. For example, former JVP MP Sunil Handunnetti alleged that the government manipulated the import taxes on rice. Similarly, in the past the Sinhala media criticised the government of Gotabaya Rajapaksa for manipulating the taxes relating to sugar to benefit his close business associates.[7]

ii. Incompetence of bureaucrats

The Sinhala media also cast the specific institution of the Consumer A!airs Authority (CAA) as incompetent. In last week’s media coverage, the CAA came under scrutiny for not protecting the interests of the consumers against the shop keepers (mudalalis) who imposed the VAT on goods that had not been listed to be taxed under it. In the past, the CAA has often come under media scrutiny for being vulnerable to political pressure, and thus not effectively fulfilling its mandate.[8]

iii. Insensitivity of the intermediaries

Apart from the government and the bureaucrats, the Sinhala media criticised the mudalalis serving as intermediaries between the government and the people for being insensitive to the plight of the public. In the past, similar criticism has been levelled against ‘poli mudalalis’ (refers to ‘loan sharks’) for informal operation and unethical means of debt collection.[9]

II. Mapping the positions of political parties on the increase of the VAT

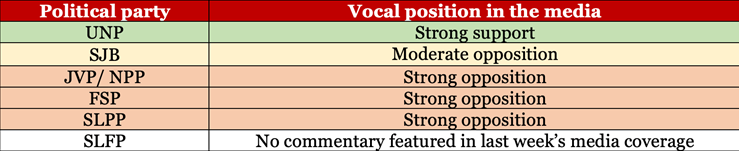

Political parties were divided on their level of support/opposition for the VAT revision. Figure 1 maps out the positions of key political parties on the increase of the VAT.

Figure 1: Mapping of political parties

i. Strong support: UNP

From across the political spectrum, the UNP was the only political party to strongly support the revised VAT. Last week’s Sinhala media featured UNP politicians vociferously defending the VAT as the only viable solution now to put Sri Lanka’s economy on the path to recovery. These voices included President Ranil Wickremesinghe, MP Wajira Abeywardana and the General Secretary of the UNP Palitha Range Bandara.

ii. Moderate opposition: SJB

The SJB appeared to have taken a moderately oppositional stance regarding the revised VAT. SJB MPs Sajith Premadasa and Harsha de Silva seemed to agree with taxation in principle but were opposed to the method in which the taxes were levied. The SJB called for the implementation of alternative methods of generating state revenue.

iii. Strong opposition: JVP/NPP, FSP and SLPP

The JVP/NPP, FSP and the SLPP strongly opposed the revised VAT.

JVP/NPP and FSP: The JVP/NPP voices included MP Anura Kumara Dissanayake and former MP Sunil Handunnetti. The FSP voices included Pubudu Jagoda and Duminda Nagamuwa. The JVP/NPP and the FSP organised several protests opposing the revised VAT.

SLPP: Despite being part of the government, the SLPP appeared to strongly oppose the revised VAT in the media. For example, the Leader of the SLPP Mahinda Rajapaksa issued a letter condemning the taxes as a burden on the public.[10]

iv. No commentary: SLFP

Last week’s Sinhala media coverage did not feature any voices from the SLFP discussing the VAT.

Overall, last week’s Sinhala media coverage reflected reduced legitimacy for further tax increases. The pragmatic outlook towards taxes visible in the immediate aftermath of the economic crisis appears to have waned, with the government now under scrutiny for increasing the VAT – a measure cast as having been taken to compensate for its incompetence and corruption.

- In accordance with TMA’s methodology to monitor social media, the TMA team filtered the 10 posts with the highest interactions on Facebook in Sinhala and English for the terms tax, VAT and TIN using CrowdTangle, from December 31, 2023 to January 5,

- See TMA 12, #34.

- For more information, please see https://plk/en/topics/vat-to-reach-20-year-high-from-january-1698838459.

- Ibid.

- For more information, see: https://economycom/sri-lanka-suspends-licenses-of-five-alcohol-firms-over-unpaid-taxes- 138697/ and https://island.lk/mendis-and-randenigala-distilleries-pay-rs-116-mn-in-tax-arrears/.

- For more information, see: https://www.sundaylk/220605/business-times/casinos-owe-huge-sums-in-taxes-to-the-ird- 484458.html.

- For more information, see: https://www.sundaylk/231105/business-times/second-sugar-scam-after-questionable-sugar-tax- hike-537305.html and https://www.newsfirst.lk/2022/04/17/sugar-tax-scam-recover-loss-of-rs-16b-from-importer-audit-office/.

- See TMA 12, #04.

- See TMA 09, #11.

For more information, see: https://english.newsfirst.lk/2023/12/20/mahinda-rajapaksa-seeks-stability-backs-tax-cuts.

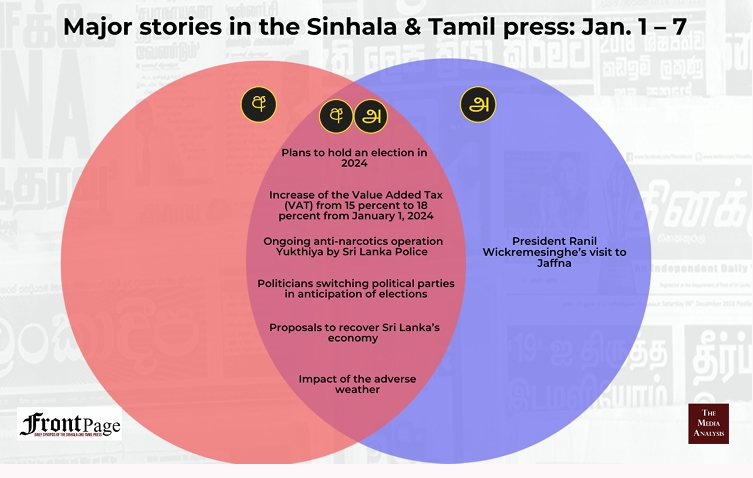

02. The Language Divide

Signposts the diWerences and nuances in reporting between Sinhala and Tamil language newspapers

The past week’s Sinhala and Tamil press converged in relation to six main stories. The six stories were on the: (i) increase of the Value Added Tax (VAT) from 15 percent to 18 percent from January 1, 2024; (ii) ongoing anti-narcotics operation Yukthiya by Sri Lanka Police;

(iii) plans to hold an election in 2024; (iv) politicians switching political parties in

anticipation of elections; (v) proposals to recover Sri Lanka’s economy; (vi) impact of the adverse weather. The Tamil press exclusively featured President Ranil Wickremesinghe’s visit to Jaffna. The Sinhala press did not feature any cover story exclusively.

Do you want to see the divided priorities on a daily basis? Check out FrontPage. It captures the day’s headlines and features succinct summaries of the political news reported in the most widely read Sinhala and Tamil newspapers.

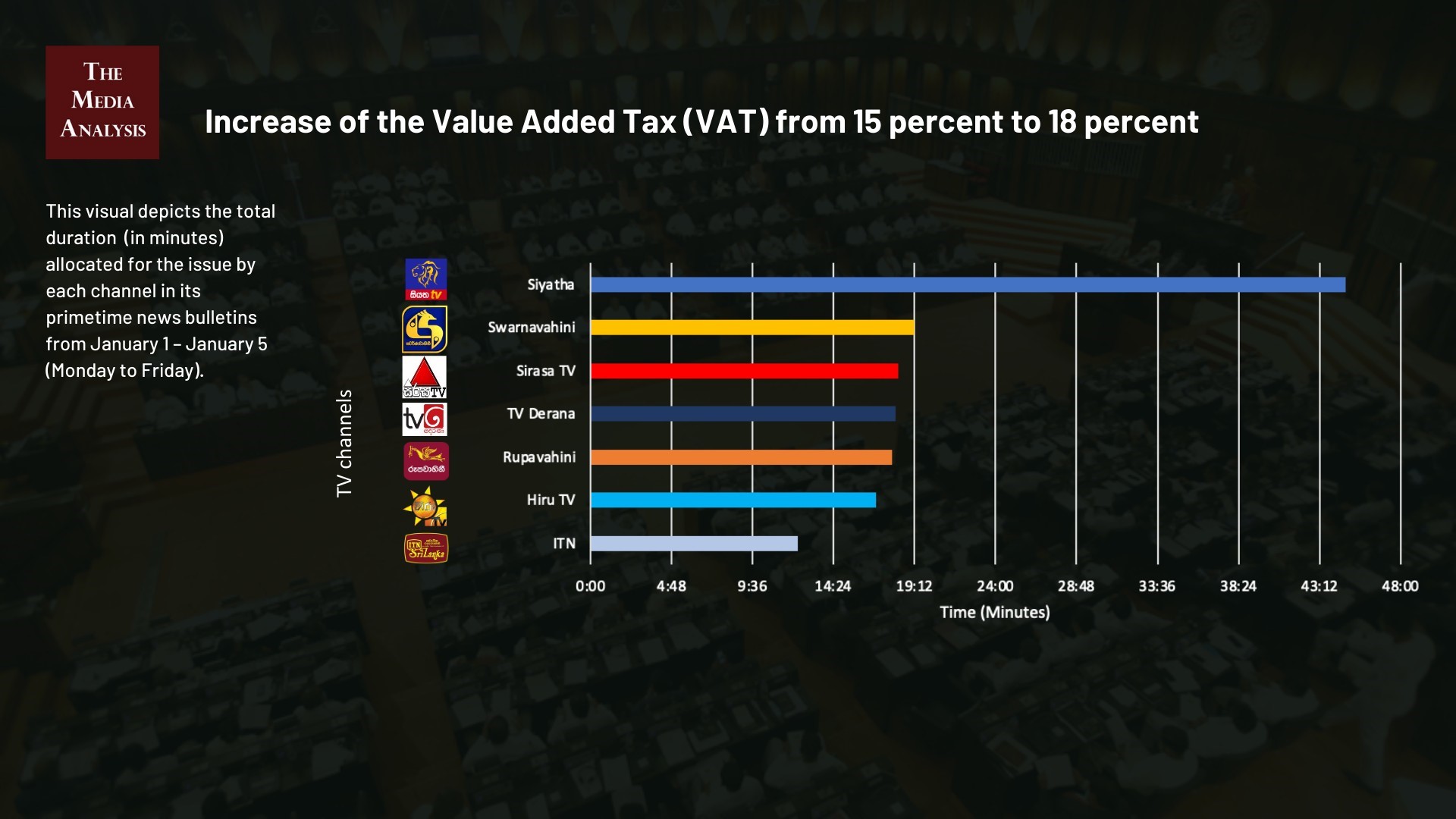

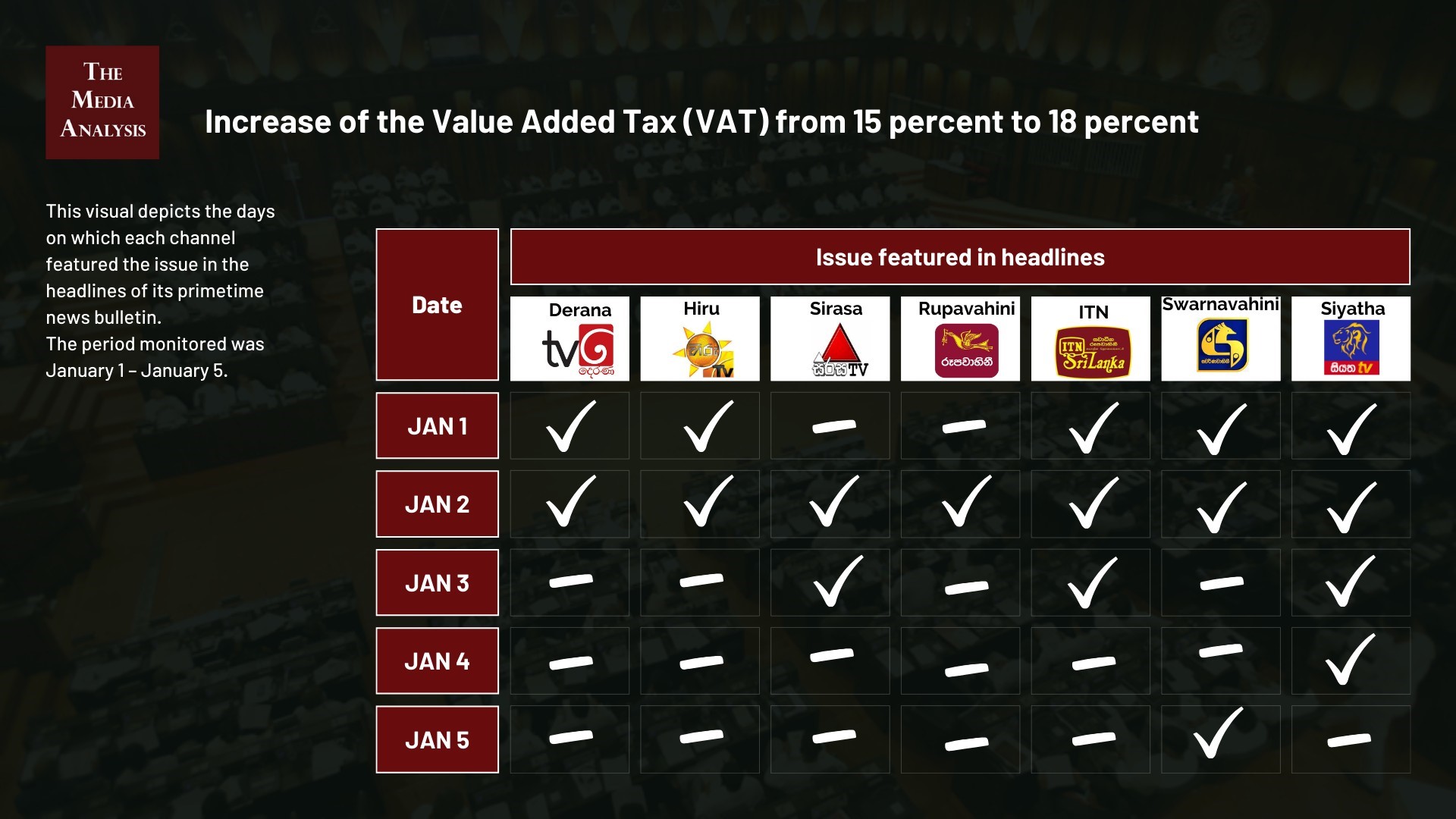

03. The TV coverage of the issue

The data on television coverage is based on the monitoring of the primetime news telecasts of selected Sinhala language TV channels uploaded to YouTube

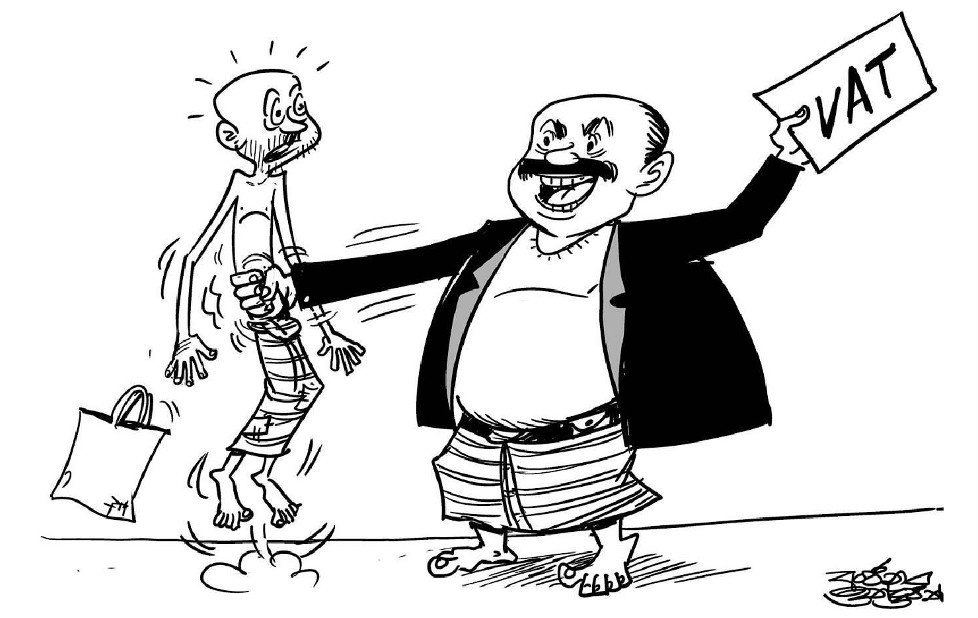

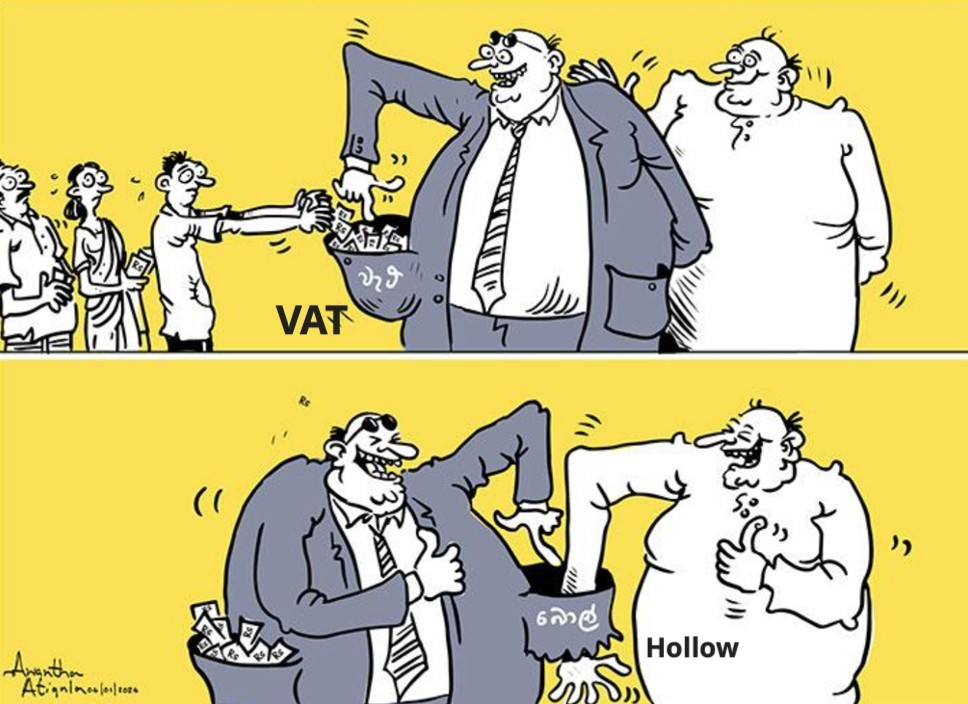

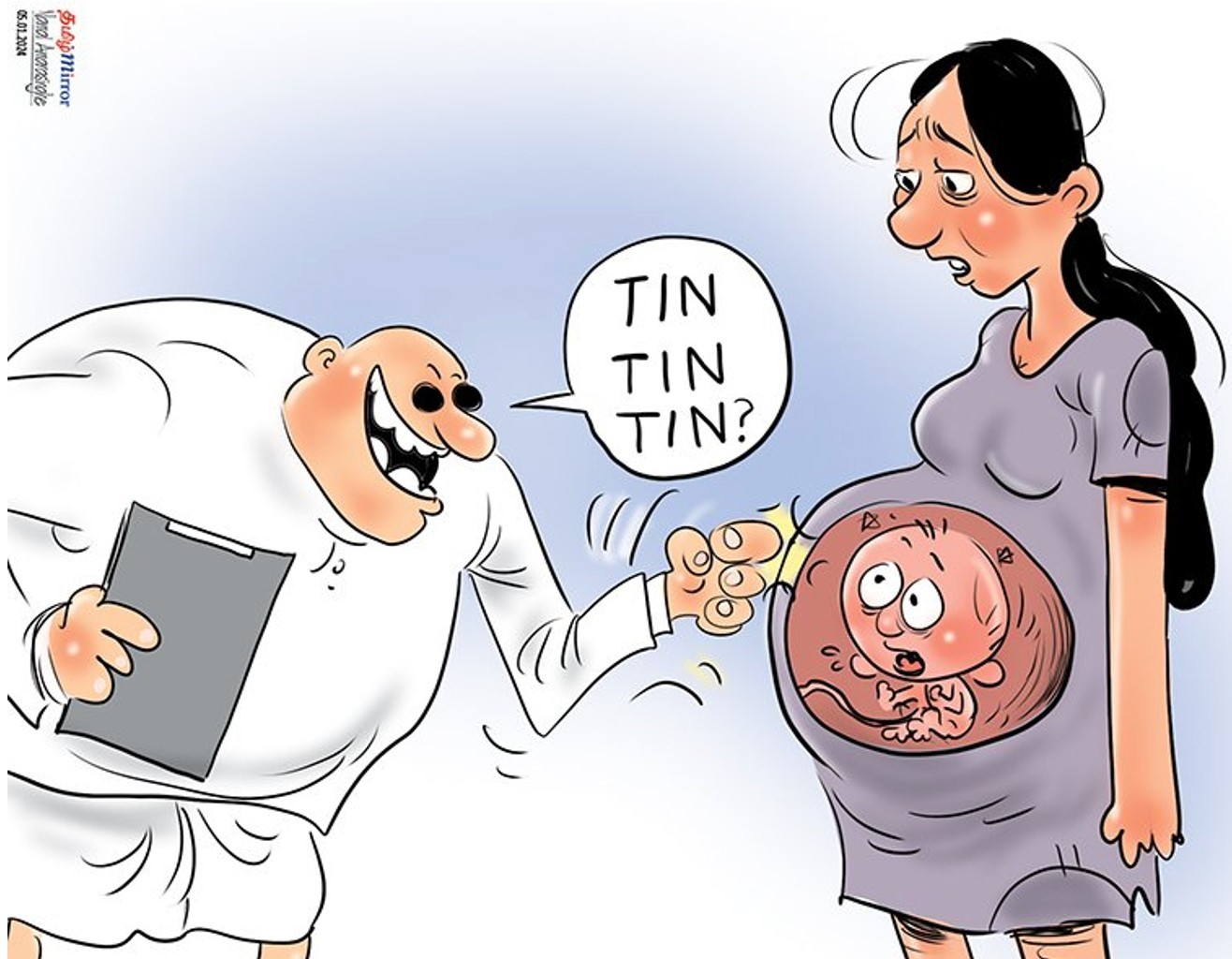

04. This week’s cartoons

Courtesy of Dinamina, Jan.2, 2023

Courtesy of Lankadeepa, Jan.1, 2023

Courtesy of Lankadeepa, Jan.7, 2023

Courtesy of Ada, Jan.4, 2023

Courtesy of Aruna, Jan.4, 2023

Courtesy of Mawbima, Jan.4, 2023

Courtesy of Tamil Mirror, Jan.2, 2023

Courtesy of Tamil Mirror, Jan.4, 2023

Courtesy of Tamil Mirror, Jan.5, 2023

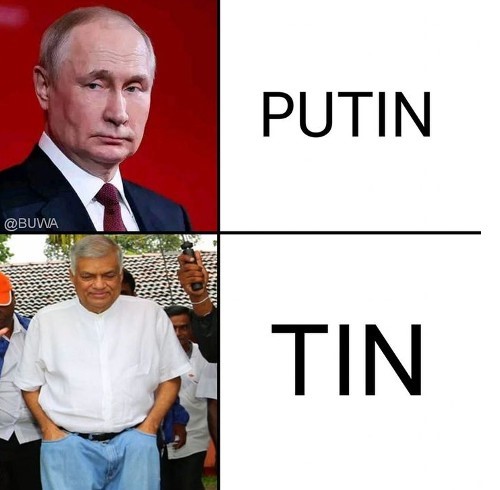

05. This week’s memes

I also bought a TIN because I can’t be ignored.

Tax relief for best friends

Tax that has been evaded

3,882,587,113.29

Let’s pay taxes!

Context: Arjun Aloysius is one of the major shareholders of Perpetual Treasuries which was accused of insider trading (the incident that is commonly referred to as the bond scam of 2015). Arjun Aloysius is the son-in-law of the former Central Bank Governor Arjuna Mahendran. Aloysius was arrested by the Sri Lanka Police in relation to the bond scam. The charges against Aloysius and Mahendran were dropped by the Colombo High Court.

On the way to get a TIN number.!

People who enjoy the taxes they pay.

People who enjoy paying taxes to cover up what is stolen.

My TIN is ready.

Get your TIN today itself.

Sri Lankans: Why did you reduce the price of kerosene? Is it to set ablaze and die?

06. Other topics covered in reportage

- Opposition to the restructuring of the Ceylon Electricity Board (CEB)

- Deaths by suicide due to alleged religious extremism

- Reported spread of measles and dengue across the country

- Reported shortage of medicines

To view this week’s news summaries, please click here